Effective October 2, 2023 we have upgraded our RepublicOnline platform, should you encounter any challenges, please contact rbbbinfo@rfhl.com or call 1-246-227-2700.

View

Conduct

RepublicOnline is compatible with the following Internet browsers:

Please use the following link to register for personal online banking: https://republiconlinebb.rfhl.com/RBBB.UI/#/administrationGeneral/login

You will be requested to enter the following information:

Once you’ve completed the process, you’ll receive an email with your temporary password. You will then be guided to complete your first-time login, after which, you can enjoy all the benefits of our online banking services. If your account doesn’t have an associated PIN, please make an appointment and visit the Branch nearest you for further assistance.

You may Login to your Internet Banking profile using the link below.

https://republiconlinebb.rfhl.com/RBBB.UI/#/administrationGeneral/login

Your First Login

Login to RepublicOnline by entering your Username chosen at registration.

Click "next" to proceed

Enter the temporary password sent via email, then click on "next". You will then be prompted to change the password and click on "Confirm" to

confirm the change and continue. Password must be 8 to 12 characters using a capital letter, numerals. No special characters must be used.

Set Security image

The security image functions as an anti-phishing device. The image selected will be displayed whenever you Logon.

Click on "Next" to proceed to the following step of the security setup process.

Set Security Question

The secret question is used as validation to update personal data, security and User settings. The User must create his/her own secret question.

The system does not provide templates or options for the secret question.

Enter a secret question of your choice

Enter the answer to the question in the "Secret Question" field provided.

Select "Next" to proceed to the next step of the log in process.

Select Second Authentication Method

The options available are SMS and Mobile App. All users will be required to select one of these options and the mobile number to register or enroll the device.

Option 1 – SMS (only available to customers locally)

Select the SMS option from the list of security devices

Input the local mobile number (with the country code) of the device you wish to enrol.

Whenever an attempt is made to Login to Republic Online, the User will receive an SMS, containing a code/token which must be entered on the

website to validate the User.

Option 2 - Republic Mobile App

When the Mobile App option is selected, the User will be instructed to download and activate the Republic Mobile Barbados App on his/her mobile device.

Once the Mobile App is downloaded, the User will be required to sync the mobile device by using a code to link the device with their RepublicOnline profile.

An SMS code is a 6-digit code that is sent to the user’s mobile device, each time he/she logs into Internet Banking. Users will be required to use this code to log on to RepublicOnline.

An OTP (One Time Password) is a 6-digit code that can only be used once to log in to RepublicOnline and is only valid for 30 seconds and once it expires the app will generate another until the login process is complete.

The Sync option is an approval process whereby the Mobile App is synchronizing the user’s login on the web and asking for approval for the user to login. Select the Sync option on the home screen of the App and you can either swipe to approve login on or, click on menu to either Approve or Reject the login.

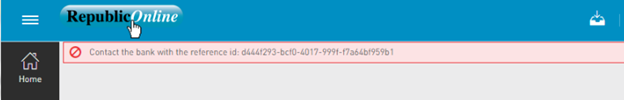

The error seen is due to connectivity challenges. Please retry and you should

be able to Login successfully.

Additionally, it is advisable to clear the cookies and cache on your browser

prior to attempting.

Please use the following link to Login to Internet Banking:

https://republiconlinebb.rfhl.com/RBBB.UI/#/administrationGeneral/login

There are no additional fees for online banking transactions. However, all standard bank charges remain applicable for the respective transactions done via online banking.

Yes. The use of our online banking is not limited to your country and is accessible in any country or location that has internet access.

Online Banking offers a variety of new features, including:

The Peer-to-Peer payment module allows customers to both request and make quick and simple payments to other Republic Bank customers. With this functionality, you can also structure collection of funds and share expenses. No information of the receiving customer's account is needed, only their cell phone number, which can be selected from the contact list or a new one can be entered if it was not registered. Both the customer initiating the request and the recipient must be active RepublicMobile App customers and have the Payments with Friends feature enabled and configured.

If the recipient has not yet signed up for RepublicMobile or has not configured Payment with Friends, the transaction will remain in a “pending” status and a notification will be sent via SMS to the intended beneficiary along with instructions for downloading the Mobile App for the payment to be completed and confirmed.

Cardless Cash is a feature of online banking (Personal) which allows users to access up to BBD$1,000 or US$370. daily at any Republic Bank ATM, without the use of a card. These funds can be sent to yourself or anyone with a mobile number.

Once a Cardless Cash transaction is completed, a Transaction ID and Cash Code will be sent via SMS (text) to facilitate accessing cash via the ATM. These codes are only valid for one-time use and expire within 48 hours.

Firstly, you are required to assign a Site Administrator for your Company. The Site Administrator will be responsible for the Company's Internet Banking profile, adding Company Users, and assigning permissions to these Users.

Using the link below, please download the Corporate Registration form for completion. Once read, you check the box to agree the Terms and Conditions.

On page five (5) kindly download the registration form.

When completed scan and email the signed forms to

ecibsupport@rfhl.com.

https://republiconlinebb.rfhl.com/RBBB.UI/#/administrationGeneral/login

Please note that the forms must be signed by the Company's authorized

signatories/Directors in accordance with your mandates held by the Bank.

A business site refers to the company’s internet banking profile.

The Site Administrator manages the company’s RepublicOnline site/account and has the authority to assign rights and permissions to themselves, establish other company users and assign rights and permissions to these.

Yes. A business site can have more than one site administrator, however the second site administrator will have to be created by the initial site administrator.

Requests for the removal or disabling of a site administrator must be submitted to the bank. The company will need to advise of the new site administrator when making the request. This request must be authorised by the company’s directors

Corporate clients will now have one platform to conduct their daily transactions as well as salary payments. Customers may choose the option of creating the salary file within the internet banking application or using the file upload option.

Yes. Salary and Supplier payment files can be uploaded to RepublicOnline provided that they are in the required format.

For salary or supplier files the following information is required for all beneficiaries: Beneficiary Name, Beneficiary Bank , Account Type, Account Number, Payment Amount. All beneficiaries must have local currency accounts.

There is no maximum number of beneficiaries that can be added to the salary/supplier file when using the file upload option.

Republic Bank beneficiaries will receive their payments immediately, while other Local bank beneficiaries will receive their payments by the end of the business day, once submitted before 3:30 p.m.

See Table below:

| Online Banking Features | Maximum Daily Limit | Transfers Between your own Accounts | BBD $999,999,999.00 |

|---|---|

| Transfer to Republic Bank Accounts | BBD $1,000,000.00 |

| Transfer to Local Banks | BBD $500,000.00 |

| Wire Transfers | BBD $500,000.00 |

| Utility Payments | BBD $250,000.00 |

| Credit Card Payments | BBD $250,000.00 |

| Loan Payments | BBD $25,000.00 |

| Third Party Credit Card Payments | BBD $25,000.00 |

| Supplier Payment | BBD $500,000 |

| Payroll Payments | BBD $1,000,000.00 |

Online banking offers a safe and convenient platform for all your banking needs. It provides enhanced security features such as second-factor authentication, a security image and secret questions/answers.

When creating your password, it should be 8 to 12 characters long and include at least a capital letter and a number. No special characters are allowed.

You are not required to change your password, as passwords do not expire on RepublicOnline.

RepublicOnline’s second-factor authentication is an additional layer of security to ensure your online banking profile is protected. It is an additional step in the login process, which will now be done using your mobile device.

You can now choose to use an SMS Code (text), a One Time Password (OTP) or Sync options for your second-factor authentication.

SMS Code

An SMS code is a 6-digit code that is sent to your mobile device, via text, each time you start logging in. You will be required to enter this code to gain access. Please note, standard SMS charges will apply.

OTP

An OTP is a 6-digit code that can only be used once to login and is only valid for 30 seconds. Once it expires, the app will generate another OTP every 30 seconds until the login process is complete.

Sync

The Sync option is a process where the Mobile app prompts for your approval when attempting to login. To activate Sync Approval, go to the RepublicMobile app, select the ‘Sync Approval’ button on the home screen and simply select either ‘Approve’ or ‘Reject’ as desired to continue.

To add an alternative second-factor authentication method, follow the steps below:

Please note: once a second authentication method is enabled, it cannot be disabled.

If you forgot your password, select the ‘Reset Password’ link on the password screen. You will be prompted to enter your secret answer and email address. Once confirmed, a temporary password will be sent to you via email, which expires within 24 hours. When the temporary password is used to login, you will be prompted to change your password.

To unlock your profile, select ‘Unlock User’ on the password input screen. You will be prompted to enter the secret answer and your email address. Once entered correctly, you will be successfully unlocked.

NB: If a user is blocked, he/she will have to contact the bank to be unblocked.

To disable or delete your online banking profile, instructions should be sent via email to rbbbinfo@rfhl.com with the following details:

All requests must be signed

If you need to acquire your Customer # or encounter any challenges, please contact our Call Centre at 1-246-227-2700 and one of our representatives will be happy to assist.

If you change/misplace your registered mobile device, follow the steps below:

For customers with OTP (One Time Password) or SYNC as second factor authentication

On your next login, you will be requested to enter an OTP or Sync approval done via the mobile app.

For customers with SMS (text) as second factor authentication

If SMS is selected, no action is required once you have access to the same mobile number registered on our service. If you do not have access to the registered number, please follow steps 1 – 3 above, ensuring that you select ‘SMS’ in step 3.

RepublicMobile is compatible with the following smartphone operating systems:

Note the following additional mobile device requirements:

To access our mobile app - RepublicMobile, download it from the Apple App Store or Google Play Store on your mobile device. If you are already registered, enter your username and password to proceed. If you are a new user, you can sign up via the app.

There are some exceptions to the transactions that can be done on the app:

Retail users cannot do the following transactions on the app:

Corporate users cannot do the following transactions on the app:

Yes. The Mobile app is not restricted to the Barbados and is accessible in any country or location that has internet or WIFI access.

To conduct a transfer, follow the steps below:

For third party / other bank transfers, you first need to register the beneficiary via ‘Manage > Third Party Beneficiaries / Other Bank Beneficiaries’ and enter the requested information.

See Table below:

| Online Banking Features | Personal Maximum Daily Limit | Transfers Between your own Accounts | BBD $999,999,999.00 |

|---|---|

| Transfer to Republic Bank Accounts | BBD $30,000.00 |

| Transfer to Local Banks | BBD $30,000.00 |

| Wire Transfers | BBD $30,000.00 |

| Utility Payments | BBD $30,000.00 |

| Credit Card Payments | BBD $30,000.00 |

| Loan Payments | BBD $15,000.00 |

| Third Party Credit Card Payments | BBD $30,000.00 |

| Payment with Friends | BBD $2,000.00 |

| Cardless Cash | BBD $1,000.00 |

For Republic Bank Beneficiaries – The transfers are real-time. Therefore, the beneficiary will have access to the funds right away.

For Local bank transfers – Transfers submitted by 3:30pm, will be sent to the other Local banks by the end of day. Requests submitted after 3:30 p.m., will be remitted by the next day.

If your third party Other Bank transfer was unsuccessful, you will receive an e-mail advising of the failed transfer.

The standard service time of a maximum of 3 days is still applicable for wire transfers being sent through RepublicOnline.

Yes, you can complete same-currency international wire transfer transactions. For example,

if you have a USD bank account with Republic Bank, you can send funds to another USD bank account internationally.

Please note that local-currency and cross-currency wire transfers are not permitted via RepublicOnline.

If you would like to send BBD dollars to another local bank, you can avail of the Third Party Local Bank Account Transfer feature.

Please note that wire transfers can only be initiated via RepublicOnline. It cannot be done via RepublicMobile.

Similar to in-branch requests for Wire transfers, customers will require the following information to submit wire transfers via RepublicOnline: ABA number, Swift Code, Routing No./ Transit No./Sort Code, Beneficiary Name & Address, Beneficiary Bank & Branch, Beneficiary Address, Country

Yes, you can request a Manager’s Cheque in local currency only. Customers should visit any of our branches for further information on the purchase of foreign currency drafts.

You will have two options for loan payments:

Loan Payment – This is your usual monthly installment amount. The amount paid will reduce the overall outstanding balance on the loan.

Principal Payment – this is an amount, determined by you, which will be applied to the principal of the loan and is considered an additional payment. This is a separate payment to the customer’s monthly installment.

Please note that customers cannot pay off their loans via online banking.

Yes. The new system allows users the flexibility to schedule payments and transfers daily, monthly or weekly if required.

Customers with joint accounts that require more than one signature for transactions will only have ‘Viewing’ access to the joint account(s). For joint accounts that require only one signature for transactions, all account holders will be able to view and conduct transactions via online banking.